|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

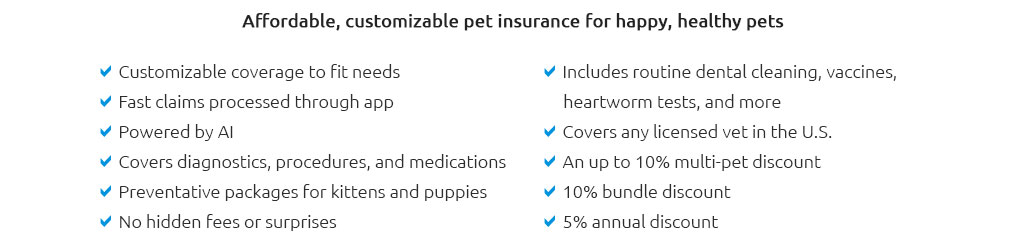

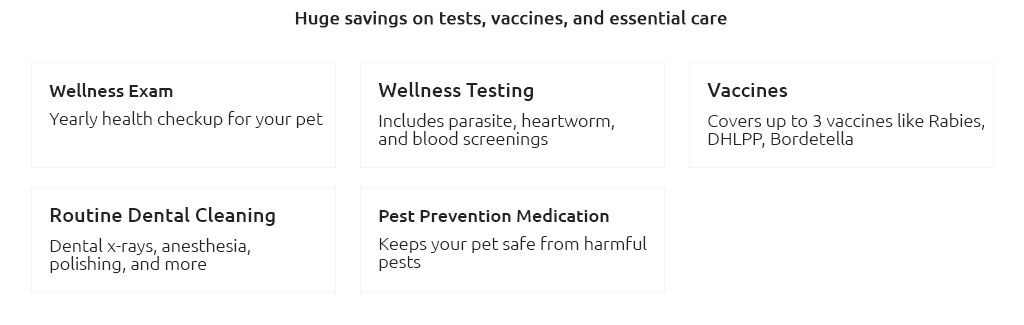

Understanding Pet Insurance: A Comprehensive Comparison GuideIn today's world, where our pets are cherished members of the family, safeguarding their health with insurance is an increasingly popular choice. However, navigating the myriad options available can be daunting, which is why a thorough comparison of pet insurance policies is essential for any pet owner. Here, we delve into the key features, subtle nuances, and the vital considerations necessary to make an informed decision. Firstly, it's important to recognize the diversity in coverage options. Policies often vary significantly, from basic accident-only plans to comprehensive packages that encompass routine check-ups, vaccinations, and even dental care. Understanding these distinctions is crucial. A comprehensive plan, while seemingly more costly, might save you substantial amounts in the long run by covering preventive care and minor treatments that could otherwise accumulate into significant expenses. When comparing pet insurance, another key factor to consider is the deductible. This is the amount you are required to pay out of pocket before the insurance coverage kicks in. Policies may offer a range of deductibles, and selecting the right one often depends on your financial comfort and your pet's health profile. A higher deductible generally translates to lower monthly premiums, which might be appealing if you are looking to minimize regular expenses.

Furthermore, the customer service experience should not be overlooked. An insurer's reputation for handling claims efficiently and compassionately can greatly influence your satisfaction with the policy. Reading reviews and gathering feedback from other pet owners can provide valuable insights into the quality of service provided by potential insurers. Finally, it's essential to consider exclusions and waiting periods. Almost all pet insurance policies have specific exclusions, such as pre-existing conditions, which will not be covered. Additionally, understanding the waiting period before coverage begins is crucial, as this could affect how soon you can start making claims. In conclusion, while the task of comparing pet insurance policies may seem overwhelming, focusing on these key areas can streamline the process, ensuring you choose a plan that offers the best balance between cost and coverage for your furry friend's needs. With a careful approach, pet insurance can provide invaluable peace of mind, allowing you to focus on enjoying the precious moments with your pet rather than worrying about unexpected veterinary expenses. https://www.moneysupermarket.com/pet-insurance/

Our customers were quoted less than 3.95 for pet insurance based on quotes created on MoneySuperMarket in the month of January 2025 where only 1 pet was ... https://www.pethub.com/insurance/quote/fletch

Pet insurance reimburses you on your dog or cat's eligible veterinary bills. It can help provide peace of mind to pet parents by offering plans that can be ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

On a monthly basis, that's roughly $17 for a dog and $10 for a cat. However, an accident-only plan won't pay for conditions such as cancer, ...

|